Accountants play a pivotal role in ensuring the financial health and compliance of businesses and individuals. They handle an array of responsibilities, from bookkeeping and auditing to tax preparation and financial advising.

To excel in their profession, accountants need access to accurate information and efficient tools. ChatGPT, with its natural language understanding capabilities, can be a valuable assistant for accountants.

In this article, we’ll explore how ChatGPT can streamline the work of accountants and provide a comprehensive list of 45 prompts tailored to their specific needs.

Best ChatGPT Prompts for Accountants

Accountants deal with complex financial data, regulations, and client interactions on a daily basis. ChatGPT can assist accountants by providing quick answers, helping with data analysis, and generating reports.

Here are 45 prompts categorized to address various aspects of accounting:

Sr. No |

Prompts for Accountants |

|

1 |

“Generate a summary of the company’s financial performance for the last financial year” |

|

2 |

“Explain in brief the amendments made in tax laws for small businesses this year.” |

|

3 |

“Create a budget analysis report for our client’s upcoming fiscal year.” |

|

4 |

“Explain the difference between GAAP and IFRS accounting standards.” |

|

5 |

“Provide recommendations for reducing tax liability for a client with multiple investments.” |

Sr. No |

Prompts for General Accounting Tasks |

|

1 |

“Explain the principles of double-entry accounting.” |

|

2 |

“Generate a general ledger report for the previous fiscal year.” |

|

3 |

“Describe the process of accrual accounting and its advantages.” |

|

4 |

“Help me understand the differences between FIFO and LIFO inventory valuation methods.” |

|

5 |

“Provide guidance on best practices for maintaining financial records.” |

Sr. No |

Prompts for Finding Errors in Balance Sheets & Ledgers |

|

1 |

“Help me identify and rectify errors in the balance sheet.” |

|

2 |

“Generate a ledger reconciliation report for the current fiscal year.” |

|

3 |

“Explain common accounting mistakes that lead to inaccurate financial statements.” |

|

4 |

“Provide guidance on handling discrepancies in trial balances.” |

|

5 |

“Describe the importance of the chart of accounts in financial reporting.” |

Sr. No. |

Prompts for Communication & Advisory with Clients |

|

1 |

“Draft an email to a client explaining their tax obligations for the upcoming quarter.” |

|

2 |

“Create a presentation on financial strategies for a business owner.” |

|

3 |

“Generate talking points for a client meeting to discuss investment options.” |

|

4 |

“Explain the benefits of incorporating sustainability practices into financial planning to a client.” |

|

5 |

“Enlist step-to-step guidance on communicating financial advice clearly to non-financial clients.” |

Sr No. |

Prompts for Data Analysis & Accounting |

|

1 |

“Analyze the cash flow trends for the past year and identify areas for improvement.” |

|

2 |

“Help me forecast future revenue based on previous data and current market trends.” |

|

3 |

“Explain the key financial ratios used to assess a company’s financial health.” |

|

4 |

“Generate a variance analysis report for our monthly expenses.” |

|

5 |

“Describe the process of data normalization and its importance in financial analysis.” |

Sr No. |

Prompts for Professional Development |

|

1 |

“How to stay updated on accounting regulations with the help of online courses and resources” |

|

2 |

“Generate a study plan for passing the CPA (Certified Public Accountant) exam.” |

|

3 |

“Explain the importance of ongoing professional development for accountants.” |

|

4 |

” Suggest few relevant webinars and workshops available online for improving accounting skills.” |

|

5 |

” Provide guidance on networking opportunities within the accounting profession.” |

Sr No. |

Prompts for Financial Advising and Planning |

|

1 |

“Recommend an investment portfolio strategy for a client with a moderate risk tolerance.” |

|

2 |

“Generate a retirement savings plan for a 40-year-old individual with specific income and goals.” |

|

3 |

“Explain the concept of diversification in investment planning.” |

|

4 |

” Help me create a financial roadmap for a client aiming to purchase their first home.” |

|

5 |

” Provide guidance on tax-efficient wealth transfer strategies.” |

Sr No. |

Prompts for Tax Document Auditing & Summarizing |

|

1 |

“”Summarize the key deductions and credits available for individual tax filers.” |

|

2 |

“Explain the red flags that auditors look for during a financial audit.” |

|

3 |

“Generate an audit report highlighting discrepancies in our financial statements.” |

|

4 |

” Provide guidance on tax-efficient strategies for a client with international income sources.” |

|

5 |

“Describe the IRS requirements for record retention by businesses.” |

Sr No. |

Prompts for Business Finances |

|

1 |

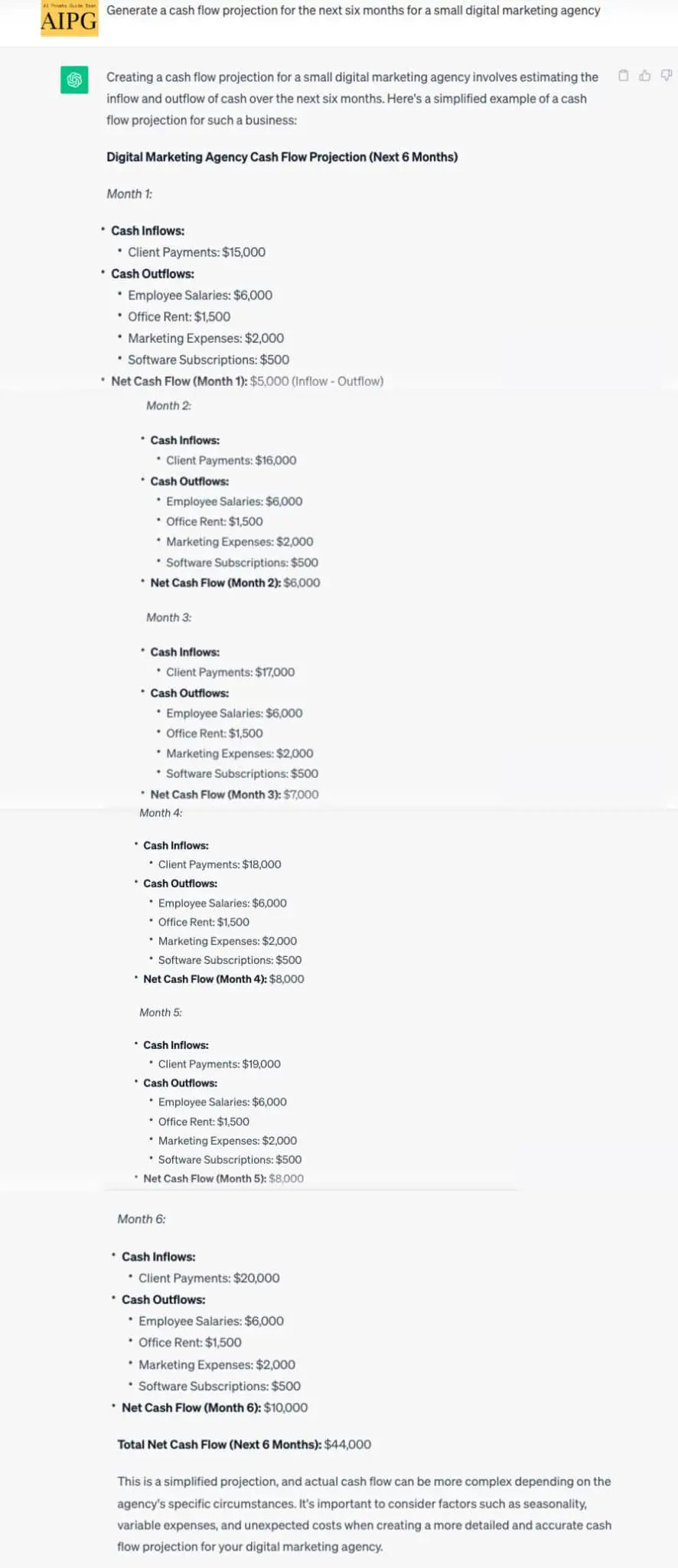

“Generate a cash flow projection for the next six months for a small [business].” |

|

2 |

“Explain the advantages and disadvantages of leasing vs. buying equipment for a business.” |

|

3 |

“Help me understand the process of raising capital through debt financing.” |

|

4 |

” Provide guidance on optimizing working capital for a growing business.” |

|

5 |

“Describe the key performance indicators (KPIs) used to assess business financial health.” |

Output

Here Is the Video !!

The Final Words

Accountants play a crucial role in maintaining financial integrity and assisting clients in making informed decisions. ChatGPT can serve as a valuable tool in their daily tasks, from data analysis to client communication.

By utilizing the right prompts, accountants can harness the power of ChatGPT to enhance their productivity and expertise in the field of accounting.